Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps

Related Articles: Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps

Introduction

With great pleasure, we will explore the intriguing topic related to Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps

- 2 Introduction

- 3 Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps

- 3.1 Deciphering the Visual Language of Heat Maps

- 3.2 Unveiling the Benefits of Heat Maps

- 3.3 Applications of Heat Maps in Stock Market Analysis

- 3.4 Navigating the Labyrinth of Heat Maps: Frequently Asked Questions

- 3.5 Enhancing Your Investment Toolkit: Tips for Effective Heat Map Utilization

- 3.6 Conclusion: Empowering Informed Investment Decisions

- 4 Closure

Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps

The stock market, a dynamic ecosystem of buy and sell orders, can appear overwhelming to the uninitiated. Navigating its complexities requires a keen understanding of market movements and the ability to identify emerging trends. Enter the stock market heat map, a powerful visualization tool that helps investors decipher the intricate landscape of financial data. This article aims to provide a comprehensive understanding of heat maps, outlining their functionalities, benefits, and applications in navigating the stock market.

Deciphering the Visual Language of Heat Maps

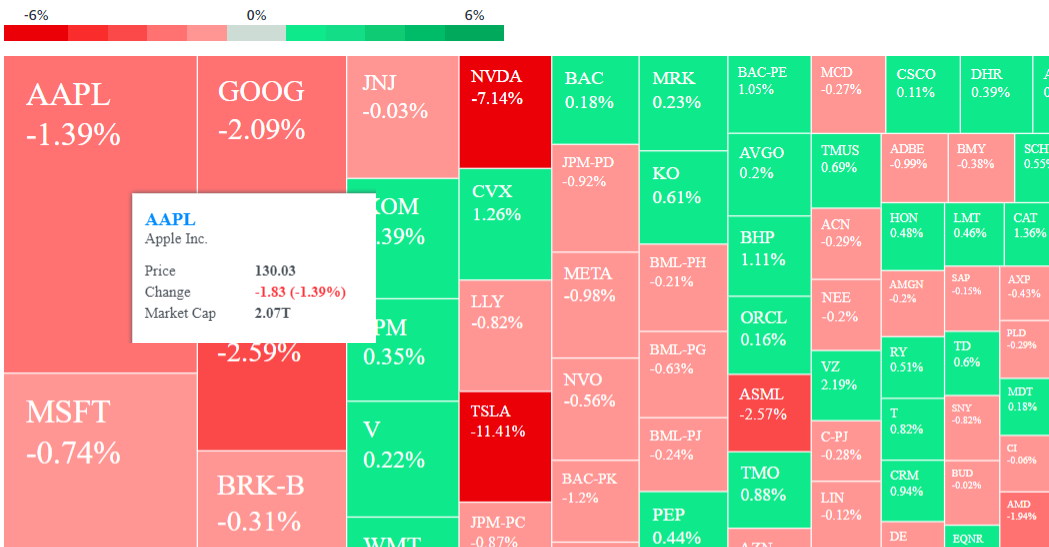

At its core, a heat map is a graphical representation of data, using color gradients to depict varying levels of activity or intensity. In the context of the stock market, heat maps typically display a range of financial indicators, such as price movements, trading volume, and volatility, across different sectors, industries, or individual stocks.

Color Coding: The Key to Interpretation

The color scheme employed in heat maps is crucial for interpreting the underlying data. Typically, warmer colors (red, orange, yellow) represent higher values, while cooler colors (blue, green) signify lower values. This intuitive color coding allows investors to quickly identify areas of high activity or potential interest.

Commonly Depicted Data Points:

- Price Movement: Heat maps can display price changes over a specific period, with warmer colors indicating significant upward movements and cooler colors representing downward trends.

- Trading Volume: Areas with high trading volume are highlighted with warmer colors, suggesting strong investor interest or potential volatility.

- Volatility: Heat maps can represent price fluctuations, with warmer colors indicating high volatility and cooler colors signaling more stable markets.

- Sentiment: Some heat maps incorporate sentiment analysis, using warmer colors to denote positive sentiment and cooler colors to represent negative sentiment.

Beyond Color: Additional Visual Cues

Heat maps often employ other visual cues to enhance their clarity and informativeness:

- Size: Larger areas or icons can indicate higher values or greater significance.

- Shape: Different shapes can be used to distinguish between different data categories or types.

- Transparency: Varying levels of transparency can be employed to highlight specific areas of interest or emphasize data relationships.

Unveiling the Benefits of Heat Maps

The use of heat maps in stock market analysis offers several significant advantages:

- Visual Clarity: Heat maps provide a clear and concise visual representation of complex data, allowing investors to quickly grasp market trends and identify potential opportunities.

- Trend Identification: By visualizing price movements, trading volume, and other key indicators, heat maps help investors spot emerging trends and potential market shifts.

- Market Segmentation: Heat maps can be used to segment the market into different sectors, industries, or asset classes, providing a granular view of market activity.

- Comparative Analysis: Heat maps allow investors to compare the performance of different stocks, sectors, or markets, facilitating informed investment decisions.

- Time-Efficiency: Heat maps provide a quick and efficient way to analyze vast amounts of data, saving investors valuable time and effort.

Applications of Heat Maps in Stock Market Analysis

Heat maps have become an indispensable tool for a wide range of market participants, including:

- Individual Investors: Heat maps empower individual investors with the ability to identify potential investment opportunities and monitor their portfolios effectively.

- Professional Traders: Traders utilize heat maps to gain insights into market sentiment, identify potential trading opportunities, and manage risk.

- Portfolio Managers: Portfolio managers employ heat maps to analyze market trends, assess portfolio performance, and make strategic asset allocation decisions.

- Analysts: Financial analysts use heat maps to research specific sectors or companies, identify market drivers, and generate investment recommendations.

Navigating the Labyrinth of Heat Maps: Frequently Asked Questions

1. Where can I find stock market heat maps?

Heat maps are readily available from various sources, including:

- Financial Websites: Websites like Yahoo Finance, Google Finance, and Bloomberg offer interactive heat maps that display market data.

- Trading Platforms: Many online trading platforms integrate heat maps into their dashboards, providing users with real-time market insights.

- Financial Data Providers: Companies specializing in financial data, such as Refinitiv and FactSet, offer comprehensive heat map solutions tailored to specific investment needs.

2. What are the limitations of heat maps?

While heat maps are powerful tools, it’s essential to recognize their limitations:

- Data Dependence: The accuracy and usefulness of heat maps depend heavily on the quality and completeness of the underlying data.

- Subjectivity: The interpretation of heat maps can be subjective, as different investors may focus on different data points or color gradients.

- Limited Context: Heat maps provide a snapshot of market activity at a specific point in time, and may not capture the full context of market dynamics.

3. How can I effectively use heat maps in my investment strategy?

- Identify Key Indicators: Determine which financial indicators are most relevant to your investment goals and focus on those displayed in the heat map.

- Consider Timeframes: Analyze heat maps across different timeframes (e.g., daily, weekly, monthly) to gain a comprehensive understanding of market trends.

- Correlate with Fundamental Analysis: Combine heat map insights with fundamental analysis of companies and sectors to make informed investment decisions.

4. Are there specific types of heat maps for different investment styles?

- Sector Heat Maps: Focus on the performance of different sectors, highlighting areas of potential growth or decline.

- Industry Heat Maps: Provide a granular view of market activity within specific industries, identifying potential investment opportunities.

- Stock Heat Maps: Display the price movements and trading volume of individual stocks, allowing investors to identify potential winners or losers.

Enhancing Your Investment Toolkit: Tips for Effective Heat Map Utilization

- Customize Your Heat Map: Select the indicators, timeframes, and color gradients that best align with your investment style and objectives.

- Compare Multiple Heat Maps: Utilize different sources of heat map data to gain a broader perspective on market trends and identify potential discrepancies.

- Combine with Other Data Sources: Integrate heat map insights with other forms of market data, such as news articles, analyst reports, and economic indicators.

- Practice and Experiment: Regularly use heat maps to gain experience in interpreting market data and refine your investment approach.

Conclusion: Empowering Informed Investment Decisions

Stock market heat maps offer a powerful visual tool for navigating the complex world of financial data. By leveraging their ability to condense vast amounts of information into easily digestible visual representations, investors can gain valuable insights into market trends, identify potential opportunities, and make more informed investment decisions. However, it’s crucial to remember that heat maps are just one piece of the puzzle, and should be combined with fundamental analysis and a thorough understanding of market dynamics to achieve successful investment outcomes.

:max_bytes(150000):strip_icc()/Heatmap-589c95ab5f9b58819cffdee0.png)

Closure

Thus, we hope this article has provided valuable insights into Unveiling Market Trends: A Comprehensive Guide to Stock Market Heat Maps. We appreciate your attention to our article. See you in our next article!