Navigating the Texas USDA Loan Map: A Guide to Rural Homeownership

Related Articles: Navigating the Texas USDA Loan Map: A Guide to Rural Homeownership

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Texas USDA Loan Map: A Guide to Rural Homeownership. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Texas USDA Loan Map: A Guide to Rural Homeownership

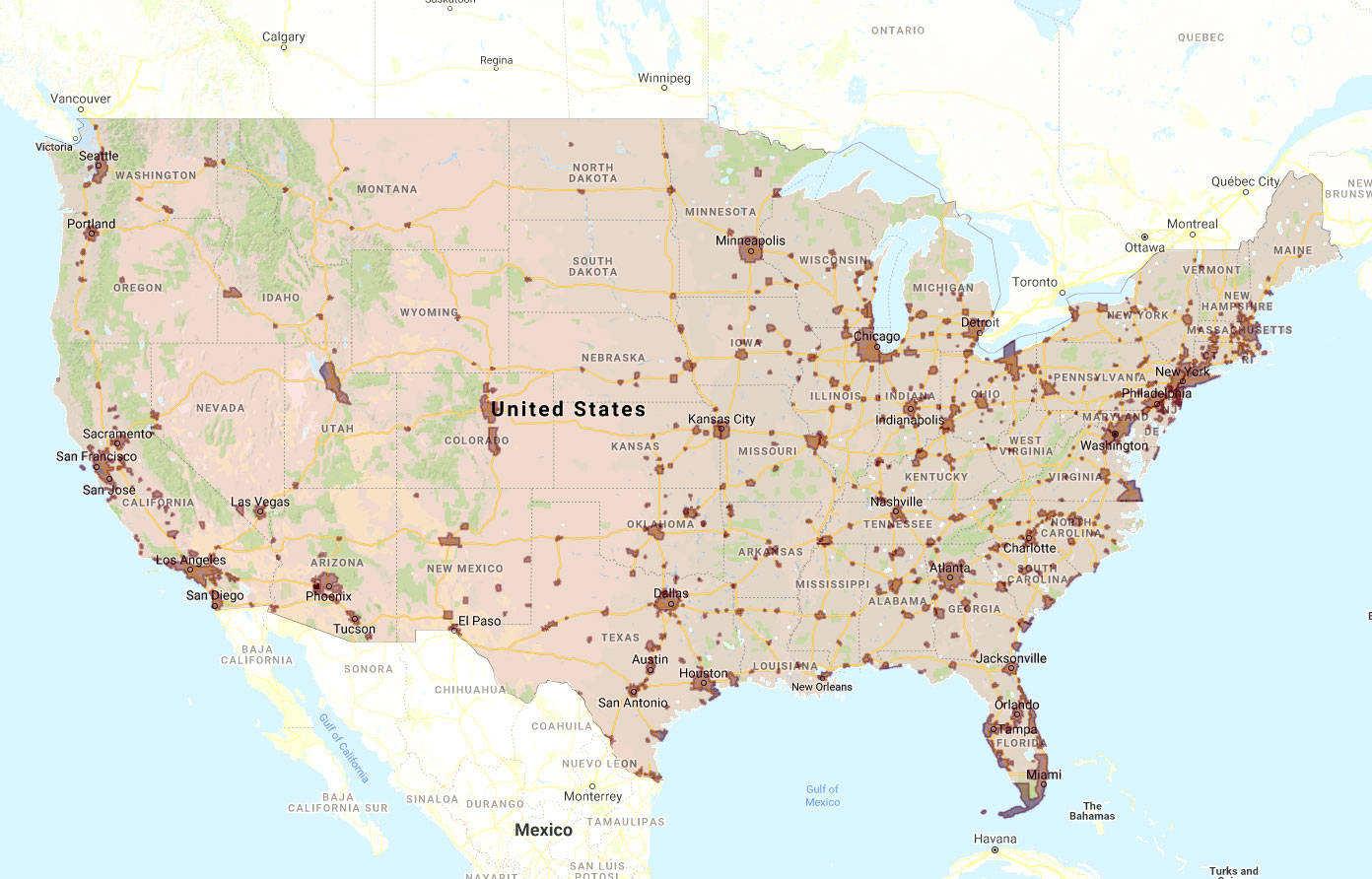

The United States Department of Agriculture (USDA) offers a range of loan programs designed to promote homeownership in rural areas. These programs, often referred to as "USDA loans," provide financing options for eligible borrowers, helping them achieve the dream of homeownership in areas that might otherwise be financially out of reach. Understanding the USDA loan map is crucial for individuals seeking to utilize these programs in Texas.

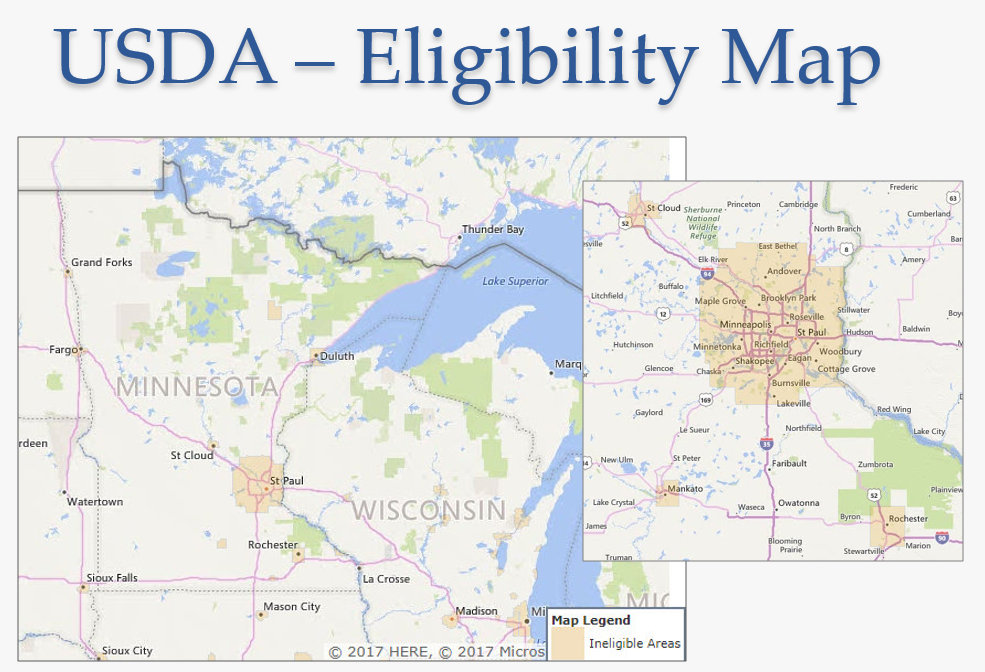

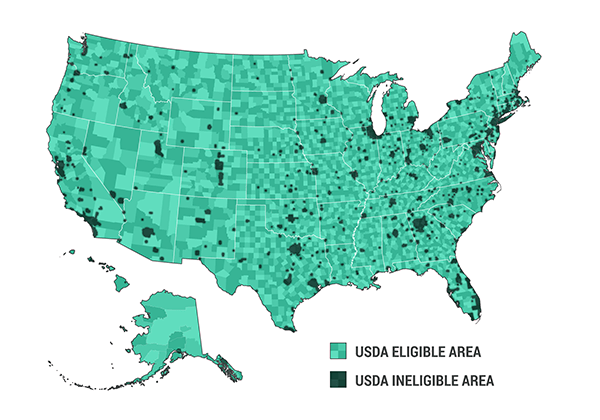

Understanding the USDA Loan Map

The USDA loan map is an online tool that visually depicts eligible areas for USDA loan programs. This map is a critical resource for potential borrowers as it provides a clear visual representation of where USDA loans are available. The map is divided into distinct areas, with eligible areas shaded in green and ineligible areas in gray.

Defining Rural: The Key to Eligibility

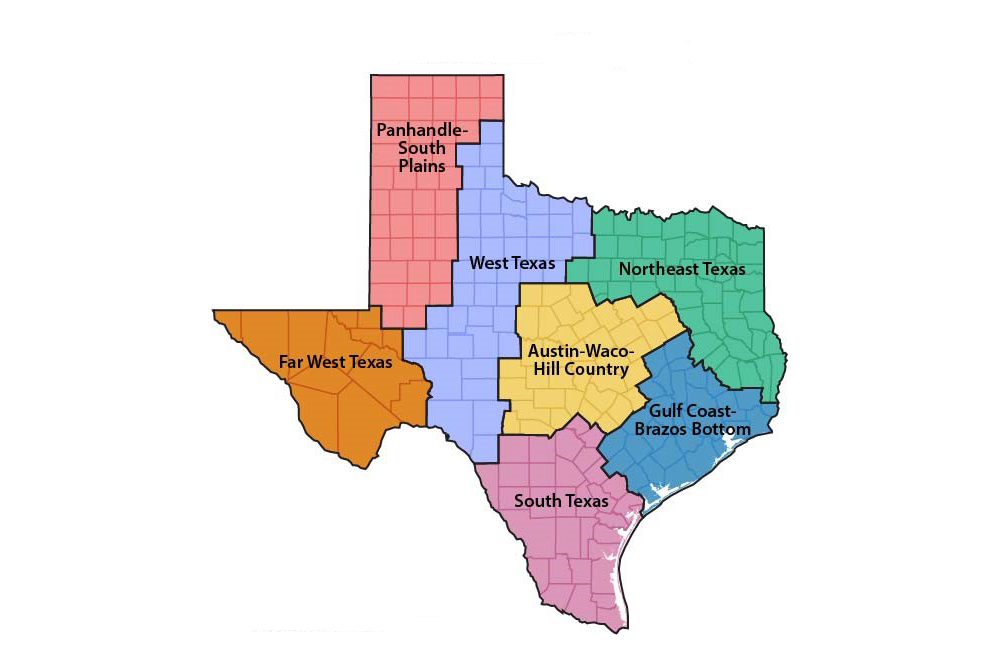

The USDA defines "rural" broadly, encompassing areas that are not classified as urban or suburban. This definition considers factors like population density, proximity to urban centers, and the availability of essential services like healthcare and education.

Navigating the Map: A Step-by-Step Guide

-

Visit the USDA Rural Development Website: The USDA loan map can be accessed directly through the USDA Rural Development website.

-

Select "Rural Development" and "Program Information" Navigate to the "Rural Development" section and then click on "Program Information."

-

Locate the "USDA Loan Map" Link: Look for the "USDA Loan Map" link, typically found under the "Housing" category.

-

Utilize the Interactive Map: The USDA loan map is interactive. You can zoom in and out, pan across the map, and search for specific locations by entering an address or ZIP code.

-

Determine Eligibility: The map will clearly show eligible areas in green and ineligible areas in gray. If your desired location is within a green-shaded area, it is likely eligible for USDA loan programs.

Key Considerations Beyond the Map

While the USDA loan map provides a valuable visual guide, several other factors influence eligibility:

- Property Type: USDA loans are primarily for single-family homes, but they can also be used for townhouses, condominiums, and manufactured homes.

- Income Limits: Income limits vary by location and household size. Borrowers must meet the income requirements for their specific area.

- Credit History: USDA loans require a strong credit history. Borrowers must demonstrate financial responsibility and creditworthiness.

- Loan Amount: USDA loans have loan amount limits that vary by location. Borrowers need to confirm the maximum loan amount available in their desired area.

Benefits of USDA Loans in Texas

- Lower Down Payment: USDA loans typically require a down payment of 0%, making homeownership more accessible for borrowers with limited savings.

- Competitive Interest Rates: USDA loans often offer competitive interest rates compared to conventional loans.

- Flexible Loan Terms: USDA loans provide flexible loan terms, offering options for borrowers with varying financial situations.

- Affordable Housing Options: USDA loans help promote affordable housing options in rural areas, making homeownership more attainable for a wider range of individuals and families.

FAQs About the Texas USDA Loan Map

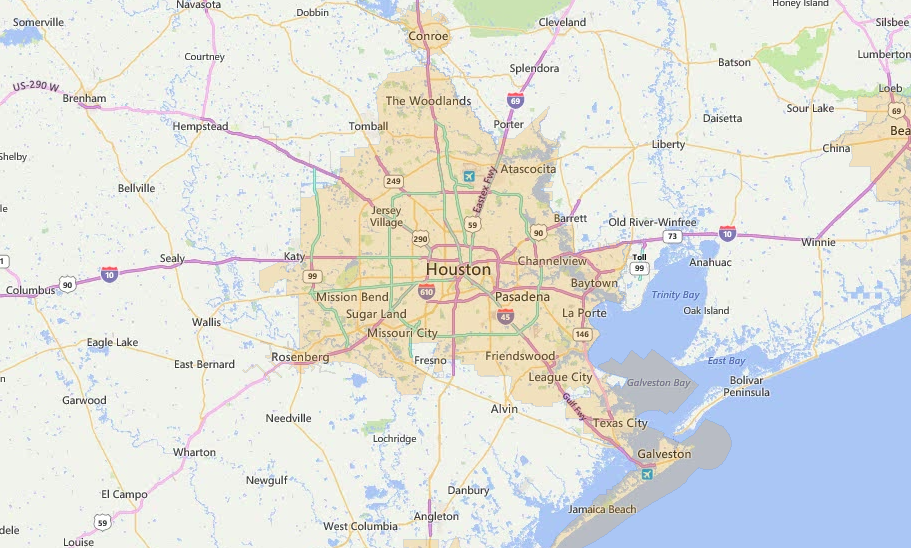

Q: Can I use a USDA loan to purchase a property in a city like Houston or Dallas?

A: No, USDA loans are not available in urban areas like Houston and Dallas. These areas are generally considered ineligible due to their high population density and urban characteristics.

Q: What if my desired property is located on the border of an eligible and ineligible area?

A: If the property is within an ineligible area, even if it is close to an eligible area, it will not be eligible for a USDA loan. The map clearly defines the boundaries of eligible areas.

Q: What are the income limits for USDA loans in Texas?

A: Income limits vary by location and household size. The USDA Rural Development website provides a tool to search for income limits based on specific counties and household size.

Q: Can I use a USDA loan to refinance an existing mortgage?

A: Yes, USDA loans can be used for refinancing purposes, but specific eligibility requirements apply. Borrowers must meet the USDA’s refinancing guidelines and ensure their existing mortgage meets the USDA’s standards.

Tips for Using the Texas USDA Loan Map

- Thoroughly Explore the Map: Take time to carefully explore the map, zooming in and out to ensure your desired location is within an eligible area.

- Consult with a Lender: Reach out to a lender specializing in USDA loans to discuss your specific needs and determine if you qualify for a USDA loan in your desired area.

- Check Income Limits: Verify the income limits for your specific location and household size to confirm your eligibility.

- Review Loan Terms: Carefully review the loan terms and conditions to understand the interest rates, repayment periods, and any associated fees.

Conclusion

The Texas USDA loan map is an invaluable tool for individuals seeking to utilize USDA loan programs for homeownership in rural areas. By understanding the map’s functionality and the key factors influencing eligibility, potential borrowers can effectively assess their options and make informed decisions. USDA loans offer a unique opportunity to achieve homeownership in areas that might otherwise be financially out of reach, contributing to the growth and development of rural communities across Texas.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Texas USDA Loan Map: A Guide to Rural Homeownership. We appreciate your attention to our article. See you in our next article!