Navigating Rural Homeownership in Georgia: A Guide to USDA Loan Eligibility

Related Articles: Navigating Rural Homeownership in Georgia: A Guide to USDA Loan Eligibility

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Rural Homeownership in Georgia: A Guide to USDA Loan Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Rural Homeownership in Georgia: A Guide to USDA Loan Eligibility

The dream of homeownership is a powerful motivator, but navigating the complex world of financing can be daunting, especially for those seeking to purchase homes in rural areas. The United States Department of Agriculture (USDA) offers a lifeline for aspiring homeowners through its Rural Development program, providing a range of loan and grant opportunities. This article will delve into the specifics of USDA loan eligibility in Georgia, offering a comprehensive guide for prospective borrowers.

Understanding the USDA Rural Development Program

The USDA Rural Development program aims to improve the quality of life in rural America by supporting economic development, housing, and infrastructure. A key component of this program is the Single-Family Housing Guaranteed Loan Program, commonly known as the USDA loan. This program offers 100% financing for eligible homebuyers, eliminating the need for a down payment and potentially reducing closing costs.

Eligibility Criteria for USDA Loans in Georgia

To qualify for a USDA loan in Georgia, potential borrowers must meet specific criteria:

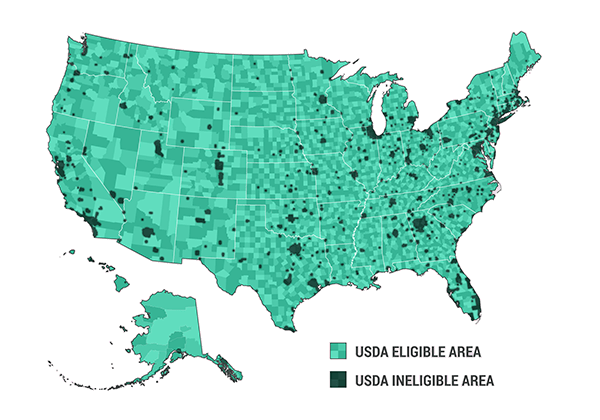

- Location: The property must be located in an eligible rural area. The USDA defines rural areas as those outside of cities and towns with a population exceeding 10,000.

- Income: Borrowers must meet income limits set by the USDA, which vary based on household size and location. These limits are generally lower than those for conventional loans, making USDA loans particularly attractive to low- and moderate-income families.

- Credit History: Borrowers must have a good credit score, typically above 640, and a history of responsible credit management.

- Property Type: USDA loans are available for a wide range of property types, including single-family homes, townhouses, condominiums, and manufactured homes. However, the property must meet specific USDA standards for size, condition, and energy efficiency.

- Purpose: USDA loans can be used for purchasing, constructing, or rehabilitating a home.

Utilizing the USDA Loan Map for Georgia

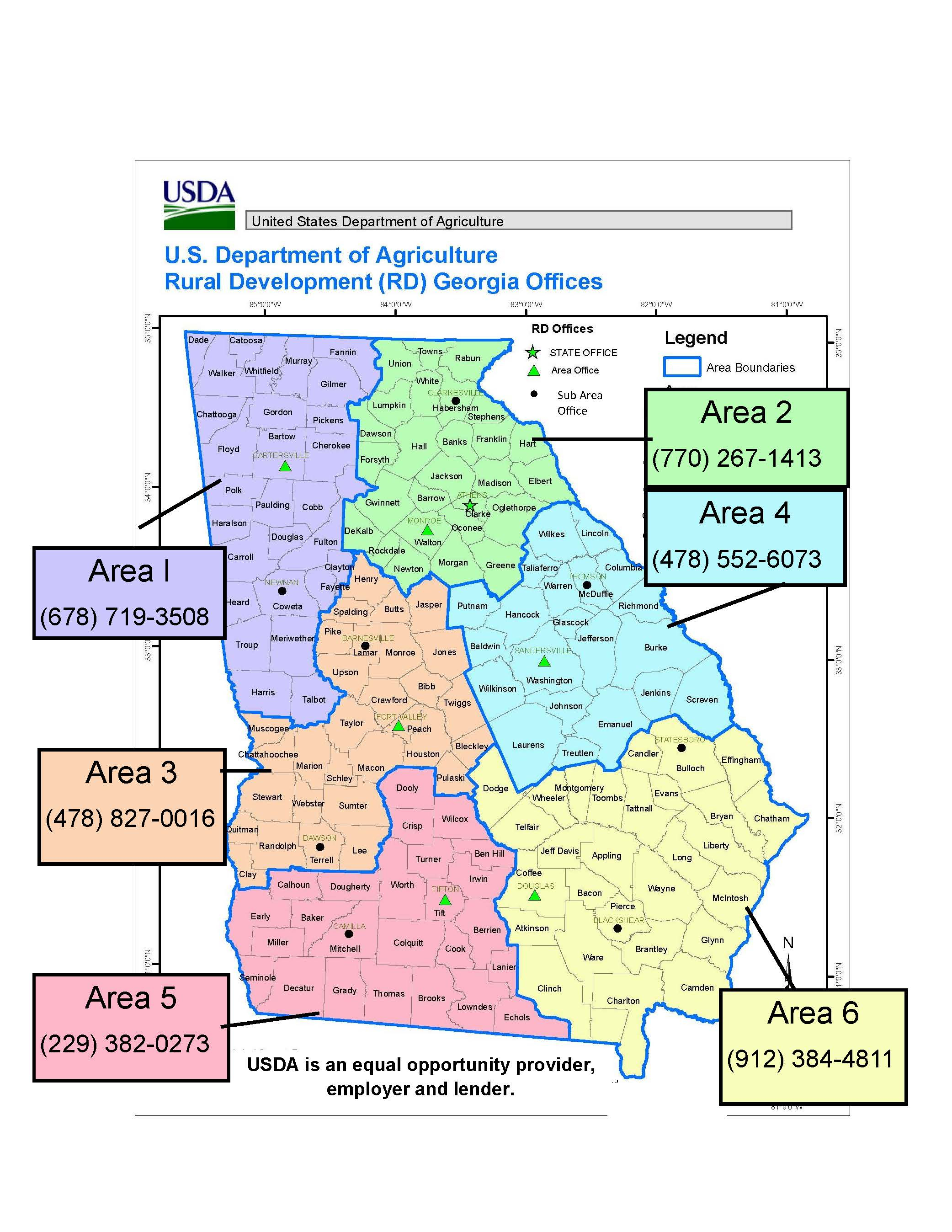

Determining whether a property falls within a USDA-eligible area is crucial. The USDA provides an interactive map tool, known as the USDA Loan Map, which allows users to search for eligible areas by address or zip code. This tool is invaluable for prospective borrowers, as it provides a clear visual representation of eligible areas within Georgia.

Navigating the USDA Loan Map

The USDA Loan Map is user-friendly and intuitive. Users can:

- Search by Address: Enter a specific address to determine if the property is located in a USDA-eligible area.

- Search by Zip Code: Enter a zip code to view all eligible areas within that zip code.

- View Map Layers: The map allows users to overlay various layers, such as income limits, property types, and program eligibility.

- Download Data: Users can download data on eligible areas in various formats, such as CSV or KML files.

Benefits of Utilizing the USDA Loan Map

The USDA Loan Map offers numerous benefits for prospective borrowers:

- Saves Time and Effort: The map eliminates the need for extensive research and phone calls to determine eligibility.

- Provides Clarity: The visual representation of eligible areas provides a clear understanding of USDA loan availability in Georgia.

- Empowers Informed Decisions: By accessing accurate and up-to-date information, borrowers can make informed decisions about property selection.

FAQs Regarding USDA Loans in Georgia

1. What are the income limits for USDA loans in Georgia?

Income limits for USDA loans vary based on household size and location. Prospective borrowers can find specific income limits for their county on the USDA website or by using the USDA Loan Map.

2. Can I use a USDA loan to refinance my existing mortgage?

While USDA loans are primarily used for purchasing homes, they can also be used to refinance existing mortgages under certain conditions.

3. Are there any closing costs associated with a USDA loan?

Yes, USDA loans typically have closing costs, which may include loan origination fees, appraisal fees, and other expenses. However, these costs can be lower than those associated with conventional loans.

4. What are the interest rates for USDA loans?

Interest rates for USDA loans are competitive and fluctuate based on market conditions.

5. How long does it take to process a USDA loan application?

The processing time for a USDA loan application can vary depending on factors such as the complexity of the application and the availability of required documentation.

Tips for Success with USDA Loans in Georgia

- Consult with a Loan Officer: A knowledgeable loan officer can guide you through the process and help you determine if a USDA loan is the right fit for your financial situation.

- Gather Required Documentation: Be prepared to provide documentation such as proof of income, credit history, and property information.

- Understand Eligibility Criteria: Thoroughly familiarize yourself with the eligibility requirements for USDA loans to ensure you meet the necessary criteria.

- Explore USDA Resources: Utilize the USDA website and the USDA Loan Map to access valuable information and tools.

Conclusion

The USDA loan program offers a valuable opportunity for individuals seeking to purchase homes in rural areas of Georgia. By understanding the eligibility criteria, utilizing the USDA Loan Map, and following the tips outlined above, prospective borrowers can increase their chances of securing a USDA loan and realizing the dream of homeownership. The USDA Rural Development program is a powerful tool for promoting economic growth and fostering vibrant communities in rural America, and its impact on the lives of individuals and families is undeniable.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Homeownership in Georgia: A Guide to USDA Loan Eligibility. We thank you for taking the time to read this article. See you in our next article!